20 Things To Consider When Day Trading: Most of us love the thrill of day trading. You enter a position in the morning and take profits at the end of the day. You don’t have to worry about withdrawal and delivery and can take classes for multiple of your funds. Unfortunately, day trading is not as easy a game as it seems. You must learn day-trading secrets before you get into day-trading. So what are the intraday trading tips to get good returns? Let’s look at 20 successful intraday trading strategies. More than just specific strategies, these are the 20 rules that can help you day trade successfully.

Twenty trading rules to become a successful day trader.

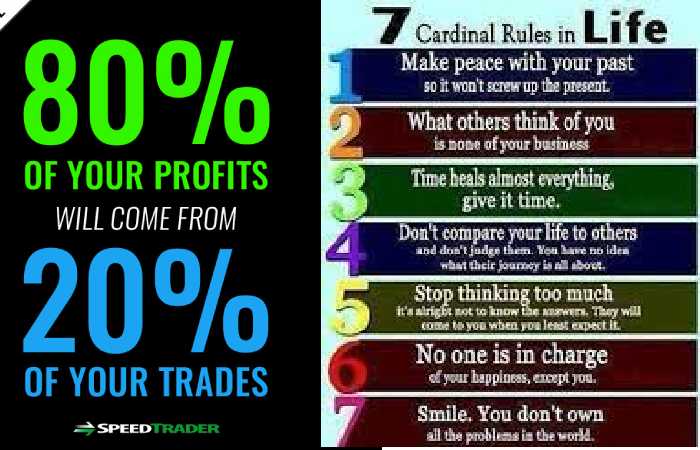

Cardinal Rule is 20 Things To Consider When Day Trading

Don’t trade in the middle of a volatile market. It is the cardinal rule. Day trading is best done when the market direction and momentum are predictable. Otherwise, you could end up spending more time triggering stop sufferers.

Protecting Capital, 20 Things To Consider When Day Trading

Day trading is about protecting capital. First, focus on the amount of loss you are willing to take overall and per trade. Intraday profits will automatically follow once you can protect your capital from depletion beyond a point.

Stop-Loss

Never trade without a stop loss. Remember that stop loss is necessary for most trades, but it is a must in day trading. Without a stop loss, you may hold positions with unmanageable MTM losses.

Profit Target

Always decide your profit mark based on our risk/reward trade-off. The stop loss is a side of the story; The other side is that you also need to take advantage of it. Let your profit bulls be a multiple of your stop loss. A 3:1 or 2:1 compromise is understandable, but not 1:1.

The Trading Range

Don’t overwhelm yourself with the trading range. Keep an eye on your worst-case loss when using margins. Don’t push yourself to the point where your losses become prohibitive in the event of a black swan.

Temptation

Avoid the temptation of tips and only act when convinced. There is no lack of research analysts and experts in the market. Most of them are just candidates for the throne. Treat these ideas with a pinch of salt. It always works better! There is no alternative to doing your research before day trading.

Staying Away From The Markets

Staying away from the markets is also essential for day traders. As a day trader, you have three critical decisions: when to buy, sell, and stop. Interestingly, most money in day trading is made when you do nothing while the rest of the market burns up profits in chaos.

Wins And Losses

Track your wins and losses and evaluate them at the end of the day. It may sound trite and clerical, but it is essential. Track the transactions that went wrong and the transactions that went right. Keep a notebook to analyze what you did wrong and could have done better. It will help you become a better trader.

Averaging Your Trades

Averaging your trades is the deadly sin of day trading. It’s pretty common to buy more stocks when they’re right. The average is wrong for two reasons. First, you run the risk of being wrong twice. Second, you may increase your exposure to a particular stock more than warranted. You could also put your capital at risk.

News

Keep an eye on the news; Otherwise, you risk failing as a day trader. Day trading is not about navigating the markets; it’s much more organized. Stay tuned for news and macros. Evaluate the flow of corporate actions and earnings announcements. This information is helpful if you want to become an informed day trader.

The Companies You Work

Know the companies you work with, what they do, their level of technology, etc. It’s not just for fundamental analysts. Also, intraday traders need to know what the company is doing and how it is performing.

Impulses And Evaluate

Learn to capture impulses and evaluate F&O data. Day trading is about being on the right side of the momentum. F&O data points such as open interest, option price accumulation, VI; Put-call ratios are essential indicators for day trading.

Panic

. Don’t panic when day trading. If you panic, subsidize the other trader who isn’t panicking. In addition, panic forces you to make rash and wrong decisions in the market, which you will surely regret in peace.

Regret Losses

Don’t regret losses; they are an essential part of intraday trading. It’s good to look back and analyze why you lost. But don’t lose sleep over the sufferers you made in a day. These are an essential part of your business. Take it easy.

Overnight Risk

If you’re a day trader, beware of overnight risk. If you’re a day trader, stick to your stuff. Holding positions overnight involves overnight risk, and your day trading capital may not be able to take that type of risk. Be careful when 20 Things To Consider When Day Trading.

Free Lunch

There is no free lunch in day trading. Don’t get carried away because you made considerable profits in a single day. The markets have an unsavory ability to hit you when you least expect it. Return is a function of risk, and nothing beats easy money.

Handsome Profits

If somewhat is too good to be true, it probably is. It is especially true if your position has generated handsome profits within an hour. Don’t try to let your luck run for a long time. If somewhat is too good to be true, take your win and walk away.

Ups And Downs

Don’t waste your time on the united states of americaand downs of the stock marketplace; it doesn’t remember in case you are a day dealer or an investor; No one has constantly captured the united states of americaand downs of the market. It is not only impossible but also needless. The brought gain is constrained, so don’t recognition on buying low and promoting high.

Excessive Trading

Never try to make up for your losses by excessive trading. It is a golden rule of day trading. When you buy and the stop loss is triggered, you sell the same position. This overtrading causes you to lose money both ways.

Golden Rule

There is no excellent rule, and only repetition will make you a good day trader. After all, the golden rule of day trading is no golden rule. It is essentially a business that requires discipline and risk management and will only get better with time. As Euclid wrote, “There is no silver bullet to geometry.” It also applies to intraday trading.

![20 Things To Consider When Day Trading [2024]](https://www.treasurebiz.com/wp-content/uploads/2022/05/Day-Trading.webp)